Although the world looks different in 2020, Rematec and Kemény Boehme & Company (KBC) regard remanufacturing to be an important instrument of after-sales. In the second edition of the exclusive Global Remanufacturing Benchmark (GRB), both organisations have gained insights into remanufacturing trends, developments and challenges. The survey was conducted before and during Rematec Amsterdam (June 2019) and Rematec Asia in Guangzhou, China (October 2019), which allows us to take a closer look at the situation in the European and Asian markets before Covid-19 shook the world. We’ll have a series of articles about industry players and challenges, markets, products and processes, core management, quality and marketing & sales. Today part 2: Markets.

Markets

Central and Eastern Europe are and remain main markets for remanufacturing and remanufactured parts. Despite the strong focus of the survey on the Asian market, in particular Central Europe plays an important role for the reman business. Furthermore, Asia-Pacific and North America are also playing an important role in this context. In particular the Chinese remanufacturing market is becoming increasingly important for international reman organisations, who are aware of the growing influence of Chinese sustainability politics and the increasing demand for new equipment (hardware) and know-how.

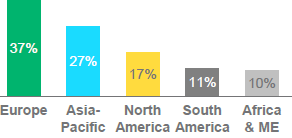

Figure 1 Remanufacturing markets

Reman plants are mostly located in Asia-Pacific (41%) and Europe (37%), followed by North America (16%). Less commonly remanufacturing is located in South America (11%), Africa and Middle East (10%).

The study participants gave an assessment of the top industries. Top industries continue to be passenger cars and trucks. We observe that the predominant focus of the reman industry on passenger cars is going to decrease in the future whereas other focus industries remain rather stable or even expand. Also in other rather niche sectors remanufacturing is becoming increasingly important. An increase is to be expected for marine (up to 11%), energy (up to 9%), trains (up to 7%), industrial machines / electronics (up to 5%), aerospace (to 4%), and health care (to 4%).

Related content

Global remanufacturing benchmark part one: Industry and Challenges

Global remanufacturing benchmark part three: Products & Processes

Global remanufacturing benchmark part four: Core management

Global remanufacturing benchmark part five: Quality

Global remanufacturing benchmark part six: Marketing and Sales

More information on the global remanufacturing benchmark