According to a recent analysis, the Global Remanufactured Automotive Parts Market is expected to increase by USD 11,021.22 million by 2027, at a CAGR of 3.93%. This report extensively covers market segmentation by vehicle type (passenger cars and commercial vehicles), component (electrical and electronic parts, engine, transmission, wheels and brakes, and others), and geography (North America, Europe, APAC, South America, and the Middle East and Africa). The average age of cars, particularly in North America and Europe, is a major driver of remanufactured parts industry growth. Vehicle components experience ongoing wear and strain as they age. Vehicle components that have worn out must be replaced in order to achieve maximum in-vehicle safety and comfort. Although some vehicle parts have extensive replacement cycles, many automotive parts wear out rather quickly. Furthermore, merchants provide remanufactured car components with a high level of dependability and performance, attracting a significant number of automobile enthusiasts. Furthermore, the increase in vehicle miles driven and the significant reliance on IC engines for vehicle mechanization are driving market expansion.

The proportion of the remanufactured market

Sales of gasoline and diesel engine vehicles have been increasing since 2017 as a result of improved personal mobility, higher household incomes, and increased commerce. The majority of vehicles sold throughout the world have internal combustion (IC) engines, particularly commercial vehicles that require diesel engines to lift high loads. As rail services for logistics are lacking in many places, the preference for road goods transit is boosting demand for commercial cars over electric and hybrid vehicles. IC engine vehicles are popular in emerging markets due to their long history and dependable aftermarket services, and while the market for BEVs has grown, the lack of infrastructure for alternative fuel vehicles in countries such as Indonesia and India is expected to keep the number of IC engine vehicles growing. Customers are resorting to remanufactured car parts because new components are too expensive, propelling the remanufactured parts market industry. A separate chapter discusses China, where BEVs have been quickly developing at home, in the United States, and Europe due to numerous benefits such as low pricing, tax breaks, and a wealth of raw materials (copper, nickel, and iron) for batteries.

3Dprinting and AI are driving the evolution of the global manufacturing industry

With the usage of augmented and virtual reality, 3D printing, or 3DP, and AI are predicted to change the industry and the automobile sector. While 3DP is now confined to low-volume parts due to expensive costs, slow printing rates, and a lack of software optimization, advancements in software and printing speed, as well as decreasing equipment costs, are projected to alter the sector. Additive manufacturing is becoming more popular, with businesses collaborating with vehicle OEMs to commercialize 3DP. Printing in numerous locations, reducing wait times, and boosting customization are all advantages of 3DP in the automobile industry, supporting the rise of automotive parts remanufacturing. Driver assistance is one of the most effective applications of AI in the automotive sector. Artificial intelligence-enabled systems use sensors to aid with steering and pedestrian recognition, monitor blind spots, and inform the driver accordingly, allowing them to take preventive measures to avoid road accidents. The unpredictability of raw material prices is a major impediment to the expansion of the remanufactured components business. Because of increased demand, taxes, tariffs, COVID-19, and production disruptions, raw material costs for remanufacturing, automobile parts have been variable over the last decade. To control costs, remanufacturers must obtain raw materials ahead of time, but any unexpected price fluctuations might have an impact on profitability. Bulk purchases can raise inventory and manufacturing expenses, and advance orders can be more expensive. Raw material price changes continue to be a serious issue for the industry.

Vehicle Type Analysis

The passenger car category will gain a large market share. The growing disposable income of the middle class is driving market expansion in this area. In 2017, the passenger automobile segment was worth USD 26,206.32 million and is predicted to expand. Each year, investments in passenger car R&D, testing, and an emphasis on standards compliance increase. All of these elements have contributed to a growth in the average life expectancy of passenger vehicles, allowing customers to stay in their vehicles for longer periods of time. Life expectancy is predicted to rise in the future due to continuous investment in research and development across the passenger car market. The electrical and electronics component category is leading the market for remanufactured automobile components due to the increasing frequency of starter and alternator replacement. The passenger vehicle segment of the vehicle type will enjoy the highest growth rate in the next years as a result of increased passenger car sales due to urbanization and globalization. Light and heavy vehicle demand will rise as well. The remanufacturing of worn parts segment is expected to dominate the remanufactured automotive parts market. North America is expected to contribute 50% of the global remanufactured parts market growth.

Market strategy

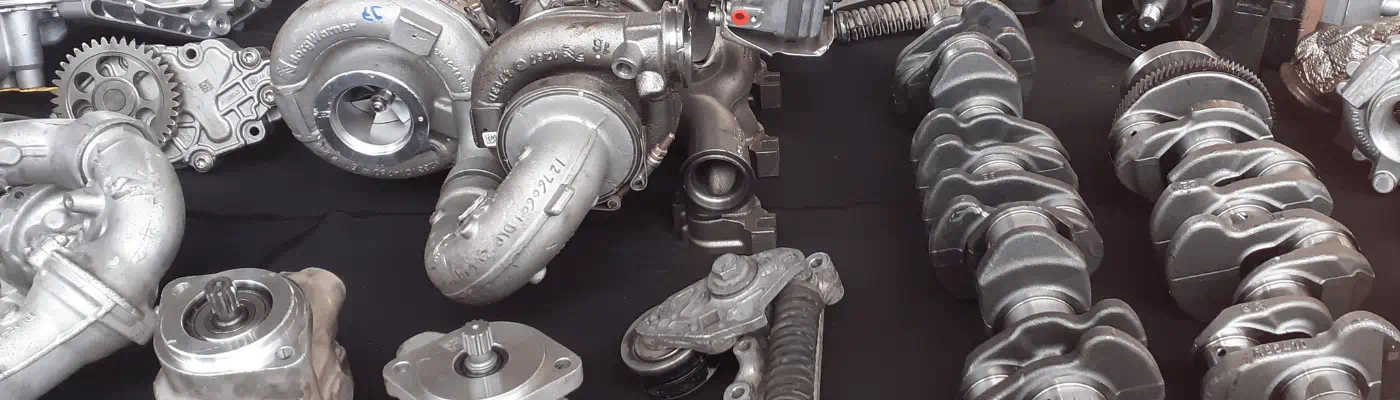

Analysts have elaborated the geographical trends and drivers shaping the market up to 2027. Commercial vehicles are plentiful in North America, accounting for over half of all cars in use. This region's sales are dominated by the LCV sector. The region's demand for commercial vehicles has expanded due to the region's expanding oil and gas business, substantial agricultural sector, extensive mining, and developing industrial manufacturing sector. In the region, heavy vehicles are commonly employed to transport minerals from mines to refineries, raw materials for manufacturing facilities, and finished products from manufacturing plants to distributors. To increase their presence in the remanufactured automotive parts market, vendors are using various tactics such as strategic alliances, collaborations, mergers and acquisitions, regional growth, and product/service launches. Transmissions, diesel engines, and gas engines are all available from a variety of firms. Oil pumps, rocker arms, connecting rods, water pumps, gasoline pumps, air compressors, and EGR valves are among the remanufactured automobile parts available. The research highlights the market's adoption lifecycle, from the innovator's stage through the laggard's stage. It focuses on penetration-based adoption rates in various regions.